Article

Best Tax Software in 2025 - Top 10 Tax Filing Programs Reviewed

Compare the best tax software for 2025. From free options to professional-grade tools, we reviewed TurboTax, H&R Block, TaxAct, and more to help you maximize your refund and file with confidence.

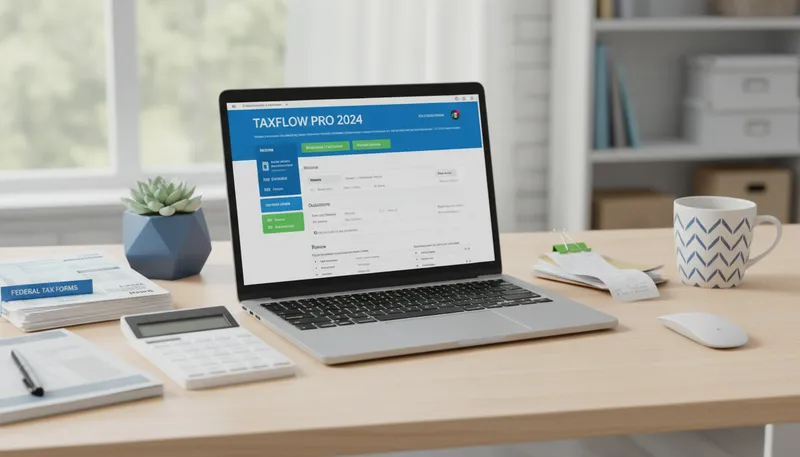

Tax season doesn’t have to be stressful. With the right tax software, you can file confidently, maximize your refund, and avoid costly mistakes—all from the comfort of your home. Whether you’re looking for a completely free option or comprehensive professional support, there’s a solution for every budget and tax situation.

Our team spent over 40 hours testing the leading tax software platforms, filing sample returns ranging from simple W-2s to complex self-employment scenarios. Here are the 10 best tax software options for 2025.

Quick Comparison

| Software | Best For | Federal Price | Rating |

|---|---|---|---|

| 1. TurboTax | Best Overall Tax Software | $69-$129 federal | ★4.9/5 |

| 2. H&R Block | Best for In-Person Support | $35-$85 federal | ★4.8/5 |

| 3. TaxAct | Best Budget Option | $25-$65 federal | ★4.7/5 |

| 4. Cash App Taxes | Best Completely Free Option | $0 | ★4.6/5 |

| 5. FreeTaxUSA | Best Value with Support | $0-$8 federal | ★4.6/5 |

| 6. TaxSlayer | Best for Self-Employed | $23-$63 federal | ★4.5/5 |

| 7. Jackson Hewitt | Best Flat-Rate Pricing | $25 flat fee | ★4.4/5 |

| 8. Liberty Tax | Best for Flexible Filing Options | Varies by service | ★4.3/5 |

| 9. OLT.com | Best for Simple Returns | $9.95 Premium | ★4.2/5 |

| 10. eFile.com | Best for Basic Filers | $19.95-$49.95 | ★4.1/5 |

Our Top Picks in Detail

TurboTax

TurboTax holds 70% of the self-filing market for good reason. Its intuitive interface, comprehensive guidance, and live expert support make it the gold standard for DIY tax preparation. While it's the priciest option, the ease of use and accuracy guarantees justify the cost for many filers.

Pros

- ✓Most intuitive interface on the market

- ✓Maximum refund guarantee

- ✓Import W-2s automatically

- ✓Live tax expert support available

- ✓Comprehensive guidance for complex situations

Cons

- ✗Most expensive option

- ✗Upselling during tax process

- ✗State returns cost extra

H&R Block

H&R Block bridges online convenience with brick-and-mortar expertise. The 2025 addition of AI-powered assistance and competitive pricing ($35-$85 vs TurboTax's $69-$129) makes it an excellent value. Free in-person audit support is a standout benefit.

Pros

- ✓In-person office support available

- ✓AI-powered assistance with paid plans

- ✓Free audit support for online filers

- ✓Significantly cheaper than TurboTax

- ✓Upload prior year returns easily

Cons

- ✗Interface less polished than TurboTax

- ✗Audit defense costs extra ($19.99)

- ✗Some features require upgrades

TaxAct

TaxAct beats competitors on price at every tier while including all tax forms regardless of plan level. The unique approach means you pay for support, not features—making it ideal for tax-savvy users who want comprehensive tools without premium pricing.

Pros

- ✓20% cheaper than TurboTax on average

- ✓Deduction Maximizer tool included

- ✓$100,000 accuracy guarantee

- ✓All forms available at every tier

- ✓Flat $60 fee for expert assistance

Cons

- ✗Less intuitive for beginners

- ✗State returns not included in free version

- ✗Interface feels dated

Cash App Taxes

Cash App Taxes is the only commercial tax software that's completely free for federal and state returns, regardless of complexity. While it lacks professional support, the inclusion of free audit defense and access to nearly all IRS forms makes it unbeatable for budget-conscious filers.

Pros

- ✓Completely free for all situations

- ✓State returns included at no cost

- ✓Free audit defense included

- ✓Access to nearly all IRS forms

- ✓No hidden fees or upsells

Cons

- ✗No professional tax support

- ✗Multistate returns not supported

- ✗Limited guidance for complex situations

FreeTaxUSA

FreeTaxUSA offers free federal filing for all income levels with the most affordable state returns at just $14.99. While the interface is basic and support is email-only, the combination of zero federal cost and budget state pricing delivers exceptional value.

Pros

- ✓Free federal filing for everyone

- ✓Cheapest state returns ($14.99)

- ✓No income limitations

- ✓Priority email support available

- ✓100% accuracy guarantee

Cons

- ✗No live chat or phone support

- ✗Interface is basic

- ✗Limited guidance compared to premium options

TaxSlayer

TaxSlayer's unique pricing model charges for support levels, not features—all forms are available at the lowest tier. This makes it ideal for self-employed filers and experienced users who want comprehensive tools at affordable prices ($23-$63 federal).

Pros

- ✓All forms included in basic plan

- ✓Excellent for self-employed filers

- ✓Quarterly tax payment reminders

- ✓30+ years in business

- ✓A+ BBB rating

Cons

- ✗Support varies by pricing tier

- ✗Can be intimidating for beginners

- ✗Lacks tooltips and definitions

Jackson Hewitt

Jackson Hewitt's straightforward $25 flat fee for unlimited state returns is refreshingly transparent. With locations inside Walmart stores and both online and in-person options, it offers flexibility and predictable pricing that eliminates the sticker shock of other services.

Pros

- ✓Flat $25 fee covers all situations

- ✓Unlimited state returns included

- ✓In-person locations at Walmart stores

- ✓No surprises or hidden fees

- ✓Covers complex tax situations

Cons

- ✗No free version available

- ✗In-person pricing varies by location

- ✗Limited online features vs competitors

Liberty Tax

Liberty Tax provides maximum flexibility with in-person, online, and remote filing options. While pricing isn't as transparent as competitors and costs can be higher for complex returns, the free consultations and accuracy guarantees provide peace of mind.

Pros

- ✓In-person, online, and remote options

- ✓Free consultations available

- ✓Accuracy guarantee included

- ✓Brick-and-mortar locations nationwide

- ✓Maximum refund guarantee

Cons

- ✗Higher costs for self-employed

- ✗Pricing not transparent upfront

- ✗Mixed reviews on value

OLT.com

OLT.com offers rock-bottom pricing ($9.95 premium edition) with live support and audit assistance. Best suited for straightforward returns, as you'll need to manually enter all forms without the convenience of document imports that more expensive competitors offer.

Pros

- ✓Very affordable ($9.95 premium)

- ✓Live customer support included

- ✓Audit support available

- ✓Multi-factor authentication required

- ✓Competitive with FreeTaxUSA pricing

Cons

- ✗Cannot import investment PDFs

- ✗Must manually enter all forms

- ✗Not ideal for complex situations

eFile.com

eFile.com has been an IRS e-file partner since 2000, offering straightforward tax filing for basic returns. While it lacks the advanced features and polish of premium competitors, its reasonable pricing and maximum refund guarantee make it suitable for simple tax situations.

Pros

- ✓Free for simple 1040EZ returns

- ✓Reasonable pricing for basic needs

- ✓Step-by-step guidance

- ✓IRS e-file partner since 2000

- ✓Maximum refund guarantee

Cons

- ✗Limited features for complex returns

- ✗Basic interface design

- ✗Fewer advanced tools than competitors

How We Evaluate Tax Software

Our testing methodology evaluates tax software across multiple critical factors to help you choose the best option for your situation.

Pricing Transparency

We analyze the complete cost picture:

- Free version limitations: What’s truly free vs. upgrade triggers

- Federal return costs: Base pricing and premium tiers

- State return fees: Per-state costs and unlimited options

- Hidden fees: Upsells, refund processing, and payment options

- Value for money: Cost vs. features provided

Ease of Use

We test the user experience from start to finish:

- Interface design and navigation flow

- Quality of guidance and explanations

- Import capabilities (W-2, prior year returns)

- Error checking and validation

- Time to complete sample returns

Tax Support

We evaluate the help available when you need it:

- Live support options (chat, phone, video)

- Access to CPAs, EAs, and tax attorneys

- Quality of in-app guidance

- Response times and availability

- Additional cost for expert help

Features and Tools

We examine the capabilities that add value:

- Deduction and credit finders

- Audit defense and guarantees

- Refund tracking and advance options

- Integration with financial software

- Year-round tax planning tools

Frequently Asked Questions

Which tax software is completely free?

Cash App Taxes is the only commercial software that’s completely free for both federal and state returns, regardless of complexity. FreeTaxUSA offers free federal filing for all income levels but charges $14.99 per state. Most other software has free versions limited to simple returns with no itemized deductions.

Is TurboTax worth the higher price?

TurboTax’s premium pricing ($69-$129 federal) is justified if you value the most intuitive interface, live expert support, and comprehensive guidance. However, TaxAct offers similar features for 20% less, and H&R Block provides comparable service at $35-$85 federal. Consider your comfort level with tax preparation when deciding.

Can I file state taxes for free?

Cash App Taxes and Jackson Hewitt ($25 flat fee includes unlimited states) are your best options for free or cheap state filing. Most other software charges $15-$69 per state. FreeTaxUSA offers the lowest a la carte state pricing at $14.99.

What’s the difference between free and paid versions?

Free versions typically cover W-2 income, standard deductions, and basic credits. You’ll need to upgrade for itemized deductions, self-employment income, rental properties, investment income, or access to tax professionals. The upgrade trigger varies by software, so review requirements carefully.

Do I need tax professional support?

Most filers can successfully use DIY software without professional help, especially for W-2 income and standard deductions. Consider professional support if you’re self-employed, have rental properties, sold investments, or have complex situations like multiple states or foreign income.

How long does it take to get my refund?

E-filing with direct deposit typically delivers refunds within 21 days, regardless of which software you use. The IRS processes all e-filed returns on the same schedule. Refund advances (available from TurboTax and H&R Block) can provide funds within 1-5 days for a fee.

What if the software makes a mistake?

All major tax software offers accuracy guarantees covering IRS penalties and interest if their software makes an error. Additionally, audit defense (included or available as an add-on) provides support if you’re audited. Always review your return carefully before filing.