Article

MyTrueIdentity Review 2026 - TransUnion Identity Protection

Complete review of MyTrueIdentity.com by TransUnion. Compare this credit bureau identity protection service with top alternatives to find the best protection.

MyTrueIdentity.com is TransUnion’s identity protection service that provides credit monitoring directly from one of the three major credit bureaus. While having direct bureau access is valuable, it only monitors TransUnion—leaving gaps in protection compared to comprehensive services.

Here’s how MyTrueIdentity compares to leading identity protection alternatives in 2026.

Quick Comparison

| Service | Best For | From/Month | Rating |

|---|---|---|---|

| 1. Aura | Best Overall Alternative | $12.00 | ★4.9/5 |

| 2. MyTrueIdentity | TransUnion Direct Access | $15.95 | ★4.3/5 |

| 3. LifeLock | Most Trusted Brand | $11.99 | ★4.8/5 |

| 4. Experian IdentityWorks | Best Bureau Direct | $24.99 | ★4.6/5 |

| 5. Credit Karma | Best Free Option | Free | ★4/5 |

Services in Detail

Aura

Aura offers more comprehensive protection than MyTrueIdentity with three-bureau monitoring, digital security tools, and superior insurance coverage in one platform.

Pros

- ✓All-in-one platform

- ✓Three-bureau monitoring

- ✓Digital security tools included

- ✓Up to $5M coverage

- ✓14-day free trial

Cons

- ✗Higher renewal rates

- ✗More features than some need

- ✗Learning curve

MyTrueIdentity

MyTrueIdentity provides direct TransUnion credit monitoring with their TrueIdentity credit lock feature, but lacks the comprehensive protection of multi-bureau services.

Pros

- ✓Direct from TransUnion

- ✓TransUnion credit lock

- ✓Bureau-direct data

- ✓Simple interface

- ✓Credit score included

Cons

- ✗Only monitors one bureau

- ✗Limited insurance

- ✗No dark web monitoring

- ✗Fewer features than competitors

LifeLock

LifeLock offers significantly more comprehensive protection than MyTrueIdentity with multi-bureau monitoring and superior insurance, backed by decades of experience.

Pros

- ✓Industry leader

- ✓Norton integration

- ✓Up to $1M coverage

- ✓24/7 support

- ✓Comprehensive monitoring

Cons

- ✗Premium pricing

- ✗Renewal increases

- ✗Basic plans limited

Experian IdentityWorks

Experian IdentityWorks offers three-bureau monitoring compared to MyTrueIdentity's single-bureau, with stronger insurance and direct Experian credit lock.

Pros

- ✓Direct bureau access

- ✓One-click credit lock

- ✓All three bureaus

- ✓FICO simulator

- ✓Daily monitoring

Cons

- ✗Higher pricing

- ✗Other bureaus quarterly

- ✗No VPN or antivirus

Credit Karma

Credit Karma offers free monitoring of TransUnion and Equifax—more bureaus than MyTrueIdentity at no cost, though without identity theft protection features.

Pros

- ✓Completely free

- ✓Two-bureau monitoring

- ✓Free credit scores

- ✓Easy to use

- ✓No commitment

Cons

- ✗No Experian

- ✗No dark web monitoring

- ✗No insurance

- ✗Limited alerts

MyTrueIdentity Limitations

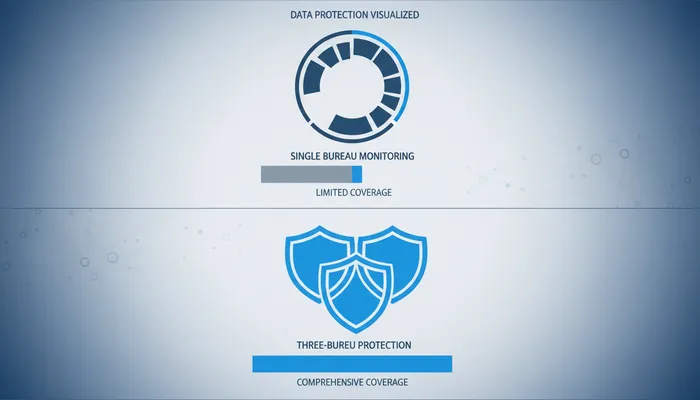

Single Bureau Coverage

MyTrueIdentity only monitors TransUnion, missing activity at Equifax and Experian. Since lenders may report to different bureaus, fraud could go undetected.

Limited Features

- No dark web monitoring

- No SSN monitoring outside credit activity

- Basic identity restoration support

- Lower insurance coverage than competitors

Better Alternatives Exist

For similar or lower prices, services like Aura and LifeLock offer three-bureau monitoring, dark web surveillance, higher insurance, and digital security tools.

Frequently Asked Questions

What is MyTrueIdentity.com?

MyTrueIdentity.com is TransUnion’s identity protection service that provides credit monitoring directly from the TransUnion credit bureau. It includes credit alerts, a TransUnion credit lock, and limited identity theft insurance.

Is MyTrueIdentity legitimate?

Yes, MyTrueIdentity is a legitimate service owned and operated by TransUnion, one of the three major credit bureaus. It’s a real product, though its single-bureau coverage limits its effectiveness.

How much does MyTrueIdentity cost?

MyTrueIdentity costs $15.95 per month for their premium tier. They also offer a free tier with limited features. However, competitors offer more comprehensive protection at similar or lower prices.

Is MyTrueIdentity worth it?

For most users, MyTrueIdentity is not the best value because it only monitors one credit bureau. Services like Aura offer three-bureau monitoring, dark web surveillance, and better insurance for similar prices.

How do I cancel MyTrueIdentity?

You can cancel MyTrueIdentity through your account settings online or by contacting TransUnion customer service. There’s no cancellation fee, though refunds depend on your billing cycle.