Article

Top 10 Best Money Market Accounts in 2025 - High APY with Check Access

Find the best money market accounts of 2025 with high APY rates, check writing privileges, and FDIC insurance. Our experts compared top MMAs to find accounts offering the best of savings and checking features.

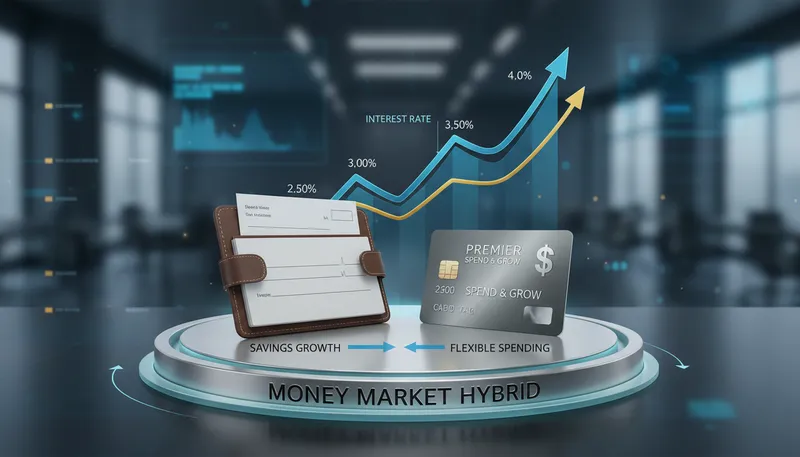

Money market accounts (MMAs) offer the best of both worlds—high-yield savings rates plus the transaction flexibility of checking accounts with check-writing privileges and debit card access. With APYs currently ranging from 3.30% to 4.25%, MMAs provide an excellent middle ground for savers who need occasional access to their funds.

Our team analyzed dozens of money market accounts, comparing APY rates, transaction features, fees, minimums, and access. Here are the 10 best money market accounts for 2025.

Quick Comparison

| Account | Best For | APY | Rating |

|---|---|---|---|

| 1. Quontic Bank Money Market | Best Overall Money Market | 4.25% | ★4.9/5 |

| 2. Ally Bank Money Market | Best for Customer Service | 3.30% | ★4.8/5 |

| 3. Sallie Mae Money Market | Best No-Minimums Option | 3.85% | ★4.7/5 |

| 4. First Foundation Bank Money Market | Best for Larger Balances | 4.00% | ★4.7/5 |

| 5. ZYNLO Money Market | Best Combined with Checking | 4.10% | ★4.6/5 |

| 6. M.Y. Safra Bank Money Market | Best Traditional Bank Option | 3.65% | ★4.6/5 |

| 7. TAB Bank High Yield Money Market | Best for Business Banking | 3.75% | ★4.5/5 |

| 8. CIT Bank Platinum Savings | Best Tiered Rate Structure | Up to 4.15% | ★4.5/5 |

| 9. Discover Money Market Account | Best for Customer Rewards | 3.70% | ★4.5/5 |

| 10. UFB Direct Money Market | Best for High-Balance Savers | 4.01% | ★4.4/5 |

Our Top Picks in Detail

Quontic Bank Money Market

Quontic Bank's Money Market Account leads the pack with an exceptional 4.25% APY while providing full checking account features including checks, a debit card, and access to 90,000+ ATMs. It's the perfect hybrid account for those who want high-yield savings with spending flexibility.

Pros

- ✓Top-tier 4.25% APY on money market

- ✓Check-writing privileges included

- ✓Debit card and ATM access (90,000+ ATMs)

- ✓No monthly maintenance fees

- ✓No overdraft fees

Cons

- ✗$100 minimum deposit to open

- ✗Newer bank with shorter track record

- ✗Some features require account activity

Ally Bank Money Market

Ally Bank Money Market combines solid 3.30% APY with legendary customer service and complete checking features. With no fees, no minimums, free checks, and a debit card, it's ideal for those who value exceptional support and straightforward account structure.

Pros

- ✓Outstanding 24/7 customer service

- ✓No minimum deposit or monthly fees

- ✓Free paper checks and debit card

- ✓Access to 43,000+ Allpoint ATMs

- ✓Up to $10 monthly ATM fee reimbursements

Cons

- ✗APY lower than highest competitors (3.30%)

- ✗No physical branch locations

- ✗Interest rate not tiered by balance

Sallie Mae Money Market

Sallie Mae's Money Market Account offers an attractive 3.85% APY with absolutely no minimums or fees. While it has limited transaction features compared to full-service MMAs, it's perfect for those who want high-yield savings with occasional check-writing ability.

Pros

- ✓Competitive 3.85% APY

- ✓No minimum deposit or balance requirements

- ✓No monthly maintenance fees

- ✓Up to 6 free withdrawals per month

- ✓Simple, straightforward account structure

Cons

- ✗No debit card access

- ✗Limited check-writing privileges

- ✗Primarily online-only access

First Foundation Bank Money Market

First Foundation Bank's Money Market delivers a strong 4% APY with full transaction features for those maintaining at least $1,000. The combination of competitive rates, checks, and debit access makes it excellent for savers with slightly larger balances.

Pros

- ✓Excellent 4% APY on all balances

- ✓Check-writing privileges included

- ✓Debit card and ATM access

- ✓FDIC insured up to $250,000

- ✓Relationship benefits with other accounts

Cons

- ✗$1,000 minimum deposit and balance required

- ✗Monthly fee if balance drops below minimum

- ✗Limited branch locations

ZYNLO Money Market

ZYNLO Bank offers an innovative pairing of 4.10% APY money market with 2% APY checking, creating a comprehensive high-yield banking package. With no fees, full transaction features, and competitive rates on both accounts, it's ideal for those wanting one-stop high-yield banking.

Pros

- ✓Strong 4.10% APY on money market savings

- ✓Pairs with 2% APY checking account

- ✓No monthly fees or minimum balance

- ✓Check writing and debit card included

- ✓Comprehensive digital banking platform

Cons

- ✗Newer digital bank (less established)

- ✗Customer service hours limited

- ✗Some features still in development

M.Y. Safra Bank Money Market

M.Y. Safra Bank combines traditional banking stability with competitive 3.65% APY money market rates. The $5,000 minimum makes it suitable for established savers who value the security of a well-established bank alongside modern rates and features.

Pros

- ✓Solid 3.65% APY from established bank

- ✓Full-service banking relationship benefits

- ✓Check writing and debit card access

- ✓Personal banker relationship available

- ✓Strong bank stability and reputation

Cons

- ✗$5,000 minimum deposit and balance required

- ✗Fee imposed if balance drops below minimum

- ✗Limited geographic branch presence

TAB Bank High Yield Money Market

TAB Bank's High Yield Money Market stands out with unlimited check-writing privileges and 3.75% APY. With options for both personal and business accounts and no minimums or fees, it's excellent for active check writers and small business owners.

Pros

- ✓Competitive 3.75% APY

- ✓Unlimited check-writing privileges

- ✓No minimum deposit or monthly fees

- ✓Business account options available

- ✓Debit card and ATM access included

Cons

- ✗Lesser-known bank (lower brand recognition)

- ✗Limited advanced digital features

- ✗Customer service only during business hours

CIT Bank Platinum Savings

CIT Bank Platinum Savings offers tiered APYs up to 4.15% for balances of $5,000 or more. While it has limited transaction features (6 checks monthly, no debit card), the high rate makes it attractive for those maintaining larger money market balances.

Pros

- ✓Up to 4.15% APY on balances of $5,000+

- ✓No monthly maintenance fees

- ✓Limited check-writing capability

- ✓Mobile and online banking included

- ✓Established bank with strong reputation

Cons

- ✗Requires $5,000 for highest APY tier

- ✗No debit card access

- ✗Limited to 6 checks per statement cycle

Discover Money Market Account

Discover Money Market combines 3.70% APY with check-writing access and the brand's signature benefits—free credit score monitoring and excellent customer service. The $2,500 minimum makes it suitable for moderate savers wanting a trusted name in banking.

Pros

- ✓Solid 3.70% APY with no monthly fees

- ✓Check-writing privileges included

- ✓Free FICO credit score monitoring

- ✓24/7 U.S.-based customer service

- ✓New customer bonuses sometimes available

Cons

- ✗$2,500 minimum deposit and balance required

- ✗No debit card or ATM access

- ✗Fee if balance drops below $2,500

UFB Direct Money Market

UFB Direct Money Market delivers 4.01% APY without any minimum deposit or balance requirements, making it accessible to all savers. With debit card access and limited check writing, it's a straightforward option for those wanting high-yield savings with basic transaction features.

Pros

- ✓Strong 4.01% APY with no minimums

- ✓No monthly fees or balance requirements

- ✓Debit card access included

- ✓Mobile check deposit available

- ✓Same-day transfers to linked accounts

Cons

- ✗Limited to 6 check transactions monthly

- ✗Lesser-known online bank

- ✗Basic digital banking features

How We Evaluate Money Market Accounts

Our expert team uses a comprehensive methodology to test and compare money market accounts. Here’s what we evaluate:

Interest Rates

We track and compare APY offerings:

- Current APY: How much interest you earn annually

- Tiered rates: Whether higher balances earn better rates

- Rate stability: Historical rate changes and consistency

- Comparison benchmarks: vs. savings accounts and national averages

Transaction Features

We assess checking-like capabilities:

- Check-writing privileges (unlimited vs. limited per month)

- Debit card availability and ATM access

- Online bill pay and transfers

- Mobile check deposit

- Transaction limits and fees

Fees and Requirements

We calculate the true cost of ownership:

- Monthly maintenance fees and waiver conditions

- Minimum opening deposit amounts

- Minimum balance to earn APY or avoid fees

- Per-transaction fees (if any)

- ATM and overdraft fees

Access and Liquidity

We evaluate ease of accessing funds:

- ATM network size and fee policies

- Transfer speed to external accounts

- Mobile app quality and features

- Online banking capabilities

- Branch access (if applicable)

Safety and Stability

We verify account protection:

- FDIC insurance coverage ($250,000)

- Bank financial strength ratings

- Account security features

- Fraud protection policies

Money Market Accounts vs. Other Account Types

Money Market vs. Savings Accounts

Money Market Advantages:

- Check-writing privileges (usually 6-10 per month)

- Debit card and ATM access

- May offer tiered rates for higher balances

Savings Account Advantages:

- Often slightly higher APYs

- Simpler account structure

- No minimum balance requirements (usually)

- Better for pure savings goals

Bottom line: MMAs for accessible savings you might need to spend; savings accounts for pure growth.

Money Market vs. Checking Accounts

Money Market Advantages:

- Much higher APYs (4% vs. 0.07% average checking)

- Earns significant interest on balance

- Still FDIC insured like checking

Checking Account Advantages:

- Unlimited transactions

- Better for frequent daily use

- Often no transaction limits

- May have more robust bill pay features

Bottom line: MMAs for holding larger balances that earn interest; checking for daily spending.

Money Market vs. CDs

Money Market Advantages:

- Liquid—access anytime without penalty

- Check writing and debit card access

- Variable rates may increase if Fed raises rates

CD Advantages:

- Often higher fixed rates (4.5-5%+)

- Rate guaranteed for term

- Forces you not to touch the money

Bottom line: MMAs for emergency funds needing access; CDs for money you won’t need for 6-12+ months.

When to Choose a Money Market Account

Ideal Use Cases

Emergency Funds: The perfect home for your 3-6 month emergency fund—high interest rates with check/debit access when needed.

Large Purchases: Saving for a down payment, car, or wedding in 6-12 months? Earn 4%+ while maintaining access through checks or transfers.

Cash Management: Business owners or freelancers with variable income can earn interest on operating cash while having check-writing ability.

Bridge Account: Temporarily park money between selling investments or property and deciding where to reinvest.

When NOT to Use a Money Market

Daily Spending: Transaction limits (often 6 per month) make MMAs unsuitable for daily purchases—use checking instead.

Long-Term Savings: Money you won’t touch for 3+ years might earn more in CDs, bonds, or investments.

Very Small Balances: Minimum balance requirements ($1,000-$5,000) mean MMAs aren’t ideal for those building savings from zero.

Frequently Asked Questions

Are money market accounts safe?

Yes. Money market accounts at FDIC-insured banks are protected up to $250,000 per depositor, per institution. Don’t confuse money market accounts (insured bank deposits) with money market funds (uninsured investment products).

What’s the difference between money market accounts and money market funds?

Money Market Accounts (MMAs): FDIC-insured bank accounts with variable APYs and transaction features. Safe, liquid, and protected.

Money Market Funds: Investment products that buy short-term debt. Higher potential returns but NOT FDIC insured and can lose value.

How many checks can I write from a money market account?

Most MMAs allow 6 transactions per month (transfers, checks, debit purchases combined). Some offer unlimited checks but count total withdrawals. Check writing doesn’t reduce interest earned—you’re just accessing your money.

Can money market rates go down?

Yes. MMA APYs are variable and typically follow Federal Reserve rate changes. When the Fed cuts rates, banks usually lower MMAs within weeks. However, they remain significantly higher than traditional savings (3-4% vs. 0.39% national average).

Should I keep all my savings in a money market account?

Not necessarily. Consider this allocation:

- Emergency fund: 3-6 months expenses in MMA for high rates + access

- Short-term goals: 6-18 month goals in MMAs or high-yield savings

- Long-term savings: 3+ year goals in CDs, bonds, or investments

What happens if I exceed the transaction limit?

Federal rules previously limited certain withdrawals to 6 per month, though this was suspended in 2020. Many banks still maintain limits. If you exceed them:

- You may be charged a fee ($10-15 per excess transaction)

- Repeated violations might cause account conversion to checking

- Some banks now allow unlimited transactions

Are online money market accounts better than bank branches?

Online MMAs typically offer:

- Higher APYs (4%+ vs. 0.10-0.50% at traditional banks)

- Lower or no fees

- Better digital tools

Traditional bank MMAs offer:

- In-person service

- Physical branch access

- Relationship banking benefits

Most savers find online MMAs far superior for pure earning potential.