Article

Best IUL Insurance in 2026

Compare the top 10 indexed universal life insurance companies with competitive cap rates and market-linked growth. Find the best IUL policies for cash accumulation and permanent protection.

Indexed universal life (IUL) insurance combines permanent coverage with cash value growth tied to market index performance. Unlike variable UL with direct market exposure, IUL uses caps and floors to limit both upside and downside, offering a middle ground between guaranteed and variable products.

Our research team analyzed IUL providers, comparing cap rates, participation rates, index options, and financial strength to identify the best companies for 2026.

Quick Comparison

| Company | Best For | Starting Price | Rating |

|---|---|---|---|

| 1. Allianz Life | Best Overall IUL Insurance | $195/mo | ★4.9/5 |

| 2. Pacific Life | Best for Comprehensive Options | $185/mo | ★4.9/5 |

| 3. Nationwide | Best for Mutual Company Strength | $190/mo | ★4.8/5 |

| 4. Ethos (via Ameritas) | Best for Reliability | $180/mo | ★4.8/5 |

| 5. National Life Group | Best by Sales Volume | $188/mo | ★4.7/5 |

| 6. Lincoln Financial | Best for Dual Designs | $192/mo | ★4.7/5 |

| 7. Mutual of Omaha | Best Cap Rates | $185/mo | ★4.7/5 |

| 8. F&G (Fidelity & Guaranty) | Best for Alternative Indices | $190/mo | ★4.6/5 |

| 9. Protective Insurance | Best Low-Cost IUL | $175/mo | ★4.6/5 |

| 10. Legal & General | Best Customer Experience | $188/mo | ★4.7/5 |

Our Top Picks in Detail

Allianz Life

Allianz Life has established itself as the premier IUL provider with over a century of experience and an A+ Superior rating. Their industry-leading participation rates, contractual guarantees, and innovative indexing strategies set the gold standard.

Pros

- ✓Premier provider with A+ Superior rating

- ✓40% multiplier bonus contractually guaranteed

- ✓5% guaranteed index loan rate

- ✓Exclusive Index Lock feature

- ✓Cap rates reaching 10% on select indices

Cons

- ✗Higher premiums than basic UL

- ✗Complex indexing strategies require guidance

- ✗Medical underwriting can be extensive

Pacific Life

Pacific Life earned the 2026 Bankrate Award for Best Universal Life Insurer with comprehensive IUL options, strong financial ratings, and flexible indexing strategies. Their A+ AM Best rating ensures long-term reliability.

Pros

- ✓2026 Bankrate Award for Best UL Insurer

- ✓Multiple indexed strategies available

- ✓A+ rating for financial stability

- ✓Robust rider options for customization

- ✓Excellent conversion from term policies

Cons

- ✗Requires financial advisor guidance

- ✗Higher costs for variable options

- ✗Medical exam typically required

Nationwide

Nationwide stands out as a true mutual company with no outside stockholders, meaning all profits benefit policyholders. Their unmatched financial strength and member-focused approach make them a trusted IUL provider.

Pros

- ✓True mutual company (no outside stockholders)

- ✓Unmatched size and financial strength

- ✓No holding company siphoning profits

- ✓Multiple index strategies available

- ✓Competitive cap and participation rates

Cons

- ✗Primarily agent-based sales

- ✗Application process can be lengthy

- ✗Complex products need expert guidance

Ethos (via Ameritas)

Ethos earned MoneyGeek's top rating for IUL insurance through partnership with Ameritas, offering reliable indexed universal life with multiple index strategies including S&P 500, Russell 2000, and NASDAQ-100, plus fixed account options.

Pros

- ✓MoneyGeek's best overall IUL for 2026

- ✓Overall score of 5 out of 5

- ✓S&P 500, Russell 2000, NASDAQ-100 indices

- ✓Fixed account choice available

- ✓Streamlined digital application

Cons

- ✗Lower maximum coverage than competitors

- ✗Newer partnership with less history

- ✗Limited rider options

National Life Group

National Life Group ranks in the top 3 IUL providers by annualized premium according to LIMRA reports. Their market leadership reflects competitive products, strong agent support, and reliable performance for policyholders.

Pros

- ✓Top 3 by annualized premium (LIMRA)

- ✓Market leader in IUL sales

- ✓Competitive indexing strategies

- ✓Strong financial ratings

- ✓Comprehensive agent training

Cons

- ✗Agent-based sales model

- ✗Limited direct-to-consumer options

- ✗Application timelines vary

Lincoln Financial

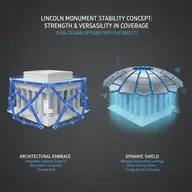

Lincoln Financial Group is a consistent leader in universal life insurance, recognized for dual design options that offer maximum flexibility. Their range of indexed, variable, and guaranteed UL policies accommodates diverse needs.

Pros

- ✓Top 3 IUL company for innovation

- ✓Dual design options for flexibility

- ✓Range of indexed and variable policies

- ✓Strong financial strength ratings

- ✓Comprehensive product lineup

Cons

- ✗Complex products require advisor guidance

- ✗Higher premiums for variable options

- ✗Extensive underwriting process

Mutual of Omaha

Mutual of Omaha offers some of the industry's highest cap rates at 12%, maximizing growth potential when market indices perform well. Their competitive caps make them a top choice for cash accumulation strategies.

Pros

- ✓12% cap rates available

- ✓Among highest caps in industry

- ✓Strong mutual company foundation

- ✓Competitive participation rates

- ✓Good cash accumulation potential

Cons

- ✗Caps subject to change

- ✗Medical exam typically required

- ✗Traditional application process

F&G (Fidelity & Guaranty)

F&G's Pathsetter IUL offers competitive performance with innovative alternative indices. Their up to 170% participation on Barclays Trailblazer Sectors 5 and 12% caps on S&P 500 strategies provide exceptional growth potential.

Pros

- ✓Competitive performance and straightforward approach

- ✓170% participation on Barclays Trailblazer indices

- ✓12% cap rates on S&P 500 strategies

- ✓Strong alternative index options

- ✓Good cash value growth potential

Cons

- ✗Complex alternative indices need explanation

- ✗Higher fees on some strategies

- ✗Limited brand recognition vs major carriers

Protective Insurance

Protective Insurance offers the most affordable indexed universal life insurance according to MoneyGeek, making IUL accessible without sacrificing financial strength. Their competitive rates provide an excellent entry point into IUL.

Pros

- ✓Most affordable IUL policies available

- ✓MoneyGeek's best for low-cost IUL

- ✓Competitive indexing strategies

- ✓Strong financial strength

- ✓Good entry point for IUL

Cons

- ✗Lower participation rates than premium carriers

- ✗Fewer index options than competitors

- ✗Cap rates may be lower

Legal & General

Legal & General America excels at customer experience with exceptional satisfaction ratings and responsive service. Their focus on policyholder relationships ensures you receive support throughout your policy's lifetime.

Pros

- ✓Excels in customer experience

- ✓High satisfaction ratings

- ✓Responsive claims service

- ✓Multiple indexing strategies

- ✓Strong underwriter backing

Cons

- ✗Primarily sold through agents

- ✗Limited direct purchase options

- ✗Application process can take time

How We Evaluate IUL Insurance Companies

Indexed universal life insurance requires specialized evaluation. Our methodology focuses on:

Cap Rates and Participation Rates

The most critical IUL features determining cash value growth potential:

- Cap rates: Maximum interest credited (typically 8-12%)

- Participation rates: Percentage of index growth credited (50-170%)

- Rate stability: How often insurers adjust caps and participation

- Historical performance: Track record of maintaining competitive rates

Top performers like Allianz offer cap rates reaching 10% with up to 100% participation on select indices, while F&G provides up to 170% participation on alternative indices.

Index Options and Strategies

We evaluate the variety and quality of available indices:

- Traditional indices: S&P 500, NASDAQ-100, Russell 2000

- Alternative indices: Barclays Trailblazer, proprietary indices

- Fixed accounts: Guaranteed interest rate options

- Index allocation flexibility: Ability to split among multiple indices

Floor Protection and Guarantees

Downside protection is crucial for IUL:

- Floor rates: Minimum crediting (typically 0-1%)

- Contractual guarantees: Allianz offers 40% multiplier bonus and 5% guaranteed index loan rate

- No-lapse guarantees: Protection against policy lapse

- Minimum death benefit guarantees

Financial Strength

IUL is a decades-long commitment requiring financial stability:

- AM Best ratings: A or better preferred (Allianz has A+ Superior)

- Company longevity: Track record through market cycles

- Market share: Leaders like National Life Group, Pacific Life, and Nationwide

- Regulatory compliance: Adherence to AG-49B illustration standards

Cost Structure and Fees

We analyze all costs impacting policy performance:

- Premium loads: Percentage of premium going to fees vs. cash value

- Cost of insurance charges: Monthly deductions for death benefit

- Administrative fees: Fixed monthly or annual charges

- Surrender charges: Penalties for early withdrawal or cancellation

Understanding IUL Market Performance

Market Growth Trends

The IUL market showed strong momentum in 2026:

- 24% of all new life insurance sales are IUL (LIMRA Q1 2026)

- 11% year-over-year premium growth

- Increasing popularity for cash accumulation strategies

- Growing use for retirement income supplementation

AG-49B Regulatory Impact

The AG-49B regulation requires more conservative illustration assumptions for IUL policies:

- More realistic projections of policy performance

- Lower illustrated values than pre-2023 standards

- Increased transparency in sales presentations

- Better consumer understanding of potential outcomes

How IUL Insurance Works

Index-Linked Growth

IUL cash value growth is tied to market index performance without direct market investment:

- Index selection: Choose from S&P 500, NASDAQ-100, Russell 2000, or alternatives

- Crediting method: Annual point-to-point, monthly averaging, or other methods

- Cap and floor application: Growth limited by cap, protected by floor

- Credit to cash value: Calculated growth credited to your policy

Example of Index Crediting

If the S&P 500 grows 15% and your policy has:

- 10% cap rate

- 100% participation rate

- 0% floor

You receive: 10% credited to cash value (capped at maximum)

If the S&P 500 loses 5%:

- You receive: 0% (protected by floor, no loss to cash value)

Cash Value Uses

Access accumulated cash value through:

- Policy loans: Borrow at favorable rates (Allianz guarantees 5%)

- Withdrawals: Take money out (reduces death benefit)

- Premium payments: Use cash value to pay premiums

- Retirement income: Tax-advantaged income stream

Frequently Asked Questions

What is IUL insurance?

Indexed universal life insurance provides permanent coverage with cash value growth tied to market index performance. It uses caps and floors to limit gains and losses, offering a middle ground between guaranteed and variable UL.

How much does IUL insurance cost?

For a healthy 40-year-old, expect to pay $175-$195+ per month for $500,000 in IUL coverage. Costs vary based on age, health, coverage amount, and chosen index strategies. IUL is more expensive than term but often less than whole life.

What are IUL cap rates and participation rates?

Cap rates limit maximum interest credited (typically 8-12%). Participation rates determine what percentage of index growth you receive (50-170%). Mutual of Omaha offers 12% caps, while F&G provides up to 170% participation on alternative indices.

Is IUL insurance a good investment?

IUL is primarily insurance with investment-like features. It’s best for those needing permanent coverage who want cash value growth potential with downside protection. It shouldn’t replace traditional retirement accounts but can supplement them tax-advantageously.

What happens if the market goes down with IUL?

Floor protection (typically 0%) ensures your cash value doesn’t decrease when the index falls. You receive 0% crediting in down years, maintaining your cash value while term and whole life policies continue growing at guaranteed rates.

Can I lose money with indexed universal life insurance?

Your cash value won’t decrease due to index losses thanks to floor protection. However, you can lose money if policy fees and cost of insurance charges exceed cash value growth, or if you surrender the policy early and pay surrender charges.

What’s the difference between IUL and variable universal life?

IUL ties cash value to index performance with caps and floors, offering limited upside with downside protection. VUL invests directly in sub-accounts with unlimited growth potential but also risk of losses. IUL is less risky than VUL.

What are the best indices for IUL policies?

Popular choices include S&P 500 (broad market exposure), NASDAQ-100 (tech-heavy growth), and Russell 2000 (small-cap exposure). Some carriers offer alternative indices like Barclays Trailblazer with different risk/return profiles. Diversifying across multiple indices often works best.

How does IUL compare to whole life insurance?

Whole life offers guaranteed cash value growth and fixed premiums but lower potential returns. IUL offers higher growth potential through market participation with floors protecting downside, plus flexible premiums. Whole life is more predictable; IUL offers more upside potential.

Are IUL cap rates guaranteed?

No, most insurers can adjust cap and participation rates annually, though they cannot go below contractual minimums. Review your policy’s guaranteed minimums and the insurer’s history of rate changes. Some carriers like Allianz offer certain contractual guarantees.