Article

Discover High-Yield Savings Review & Alternatives 2026

Discover Online Savings offers 3.65% APY with no fees and excellent customer service. Compare it to Marcus, Ally, and 8 other top alternatives to find the best high-yield savings account for your needs.

Discover Online Savings is one of the most recognizable names in high-yield savings accounts, offering 3.65% APY with no monthly fees, no minimum balance requirements, and the bonus of free FICO credit score monitoring. But is it the best choice for your savings?

We compared Discover to 10 top high-yield savings alternatives including Marcus by Goldman Sachs, Ally Bank, Bread Savings, and others to help you find the perfect account for your financial goals.

Quick Comparison

| Account | Best For | APY | Rating |

|---|---|---|---|

| 1. Bread Savings High-Yield Savings | Best Overall APY | 4.05% | ★4.8/5 |

| 2. Barclays Tiered Savings | Best for Large Balances | 3.85% - 4.00% | ★4.7/5 |

| 3. CIT Bank Platinum Savings | Best for Growing Balances | Up to 3.75% | ★4.6/5 |

| 4. Discover Online Savings | Best for Free Credit Monitoring | 3.65% | ★4.6/5 |

| 5. Marcus by Goldman Sachs High Yield Savings | Best Brand Reputation | 3.65% | ★4.6/5 |

| 6. Synchrony High Yield Savings | Best for ATM Access | 3.65% | ★4.5/5 |

| 7. Capital One 360 Performance Savings | Best for Hybrid Banking | 3.40% | ★4.5/5 |

| 8. UFB Direct High Yield Savings | Best for Any Balance | 3.40% | ★4.4/5 |

| 9. Ally Bank Online Savings | Best Customer Service | 3.30% | ★4.4/5 |

| 10. American Express High Yield Savings | Best for Amex Cardholders | 3.30% | ★4.4/5 |

| 11. Wealthfront Cash Account | Best for Investors | 3.25% | ★4.3/5 |

Discover Online Savings: Detailed Review

Best for Free Credit Monitoring

Discover Online Savings

Discover Online Savings offers a solid 3.65% APY along with valuable extras like free FICO score monitoring and award-winning customer service. While not the absolute highest rate, the combination of reliability, service quality, and consumer-friendly features makes it a trusted choice.

Pros

✓ Competitive 3.65% APY with no requirements

✓ Free FICO credit score monitoring included

✓ 24/7 U.S.-based customer service

✓ No monthly fees or minimum balance

✓ Occasional new customer deposit bonuses

Cons

✗ APY lower than top competitors

✗ No checking account integration

✗ Limited advanced savings features

Why Choose Discover?

Discover has built a reputation for customer-first banking. The Online Savings Account delivers competitive returns while including features that many competitors charge for or don’t offer at all. The free FICO credit score monitoring alone can save you $10-30/month compared to paid services.

The 24/7 U.S.-based customer service consistently ranks among the best in the industry. When you have questions or need help, you’ll talk to knowledgeable representatives without long hold times.

Discover also frequently offers new customer bonuses, typically ranging from $150-200 when you meet deposit requirements within the first few months. While these bonuses change periodically, they can provide a nice boost to your initial savings.

What Could Be Better?

While Discover’s 3.65% APY is solid, it trails dedicated online savings banks like Bread Savings (4.05%) and Barclays (3.85%-4.00%). For serious savers with large balances, this difference adds up:

$25,000 balance for one year:

- Discover at 3.65% = $912.50 interest

- Bread Savings at 4.05% = $1,012.50 interest

- Difference: $100 less per year

Discover also lacks advanced savings features like the goal-tracking buckets offered by Ally or the investment integration available through Wealthfront.

Top Discover Alternatives in Detail

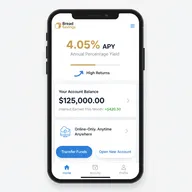

Bread Savings High-Yield Savings

Bread Savings delivers an impressive 4.05% APY with no monthly fees and a simple account structure. While it requires $100 to open, the high rate applies to balances up to $1 million, making it ideal for serious savers who want straightforward high returns.

Pros

- ✓Excellent 4.05% APY on balances up to $1 million

- ✓No monthly maintenance fees

- ✓Customer service available 7 days a week

- ✓Straightforward account with no tiers

- ✓Competitive rates on CDs also available

Cons

- ✗$100 minimum deposit to open

- ✗No physical branch locations

- ✗Limited product offerings (savings and CDs only)

Barclays Tiered Savings

Barclays offers tiered savings rates that reward larger balances, with 3.85% APY for balances under $250,000 and 4.00% APY for balances above. The no-fee structure and international banking pedigree make it attractive for high-balance savers.

Pros

- ✓Up to 4.00% APY on balances of $250,000+

- ✓Solid 3.85% APY on smaller balances

- ✓No monthly maintenance fees

- ✓No minimum deposit or balance requirements

- ✓Backed by international banking institution

Cons

- ✗Higher rate requires $250,000+ balance

- ✗No physical branch access in U.S.

- ✗Limited customer service hours

CIT Bank Platinum Savings

CIT Bank Platinum Savings rewards savers who maintain at least $5,000 with a competitive 3.75% APY. The tiered structure encourages building your balance, making it ideal for those working toward a larger emergency fund or savings goal.

Pros

- ✓Competitive 3.75% APY with $5,000+ balance

- ✓No monthly fees

- ✓Multiple savings account options

- ✓Strong online banking platform

- ✓Additional CD and money market options

Cons

- ✗Requires $5,000 minimum balance for top rate

- ✗Only 0.25% APY on balances under $5,000

- ✗$100 minimum deposit to open

All High-Yield Savings Alternatives

Discover Online Savings

Discover Online Savings offers a solid 3.65% APY along with valuable extras like free FICO score monitoring and award-winning customer service. While not the absolute highest rate, the combination of reliability, service quality, and consumer-friendly features makes it a trusted choice.

Pros

- ✓Competitive 3.65% APY with no requirements

- ✓Free FICO credit score monitoring included

- ✓24/7 U.S.-based customer service

- ✓No monthly fees or minimum balance

- ✓Occasional new customer deposit bonuses

Cons

- ✗APY lower than top competitors

- ✗No checking account integration

- ✗Limited advanced savings features

Marcus by Goldman Sachs High Yield Savings

Marcus by Goldman Sachs delivers 3.65% APY with the trust and stability of the Goldman Sachs name. The focus on simplicity with no fees, no minimums, and excellent service makes it perfect for those wanting a reputable, straightforward savings account.

Pros

- ✓Strong 3.65% APY backed by Goldman Sachs

- ✓No fees whatsoever on savings accounts

- ✓No minimum deposit or balance requirements

- ✓User-friendly mobile app and website

- ✓Excellent customer service ratings

Cons

- ✗No checking account option available

- ✗No ATM access or debit card

- ✗Limited to savings and CD products only

Synchrony High Yield Savings

Synchrony stands out by combining a competitive 3.65% APY with ATM card access and nationwide fee reimbursements. This makes it ideal for savers who want high-yield returns while maintaining convenient access to their funds through ATMs.

Pros

- ✓Solid 3.65% APY with no requirements

- ✓ATM card included for easier access

- ✓ATM fee reimbursements nationwide

- ✓No monthly fees or minimum balance

- ✓Strong online and mobile banking

Cons

- ✗Limited physical branch presence

- ✗Customer service hours could be extended

- ✗APY not the absolute highest available

Capital One 360 Performance Savings

Capital One 360 Performance Savings bridges online bank rates (3.40% APY) with occasional branch access through Capital One Cafes. The combination of no fees, strong technology, and in-person service options makes it perfect for those wanting flexibility.

Pros

- ✓Competitive 3.40% APY with no requirements

- ✓Access to Capital One Cafes nationwide

- ✓No monthly fees or minimum balances

- ✓Excellent mobile app with savings tools

- ✓Easy integration with Capital One 360 Checking

Cons

- ✗APY lower than top online-only competitors

- ✗Limited physical branch locations

- ✗Some features require Capital One credit card

UFB Direct High Yield Savings

UFB Direct, a division of Axos Bank, offers a consistent 3.40% APY regardless of your balance size. With zero fees, no minimums, and a focus on simplicity, it's an excellent straightforward savings option backed by an established banking institution.

Pros

- ✓Competitive 3.40% APY on all balances

- ✓No monthly fees or minimum requirements

- ✓No minimum deposit to open

- ✓Division of Axos Bank (established institution)

- ✓Simple, straightforward account structure

Cons

- ✗Online-only with no physical branches

- ✗Limited product offerings

- ✗Basic mobile app features

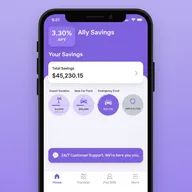

Ally Bank Online Savings

Ally Bank Online Savings prioritizes user experience and customer service over absolute highest rates. At 3.30% APY with zero fees, innovative savings tools like buckets and boosters, and legendary 24/7 support, it's ideal for those who value service quality.

Pros

- ✓Outstanding 24/7 customer service

- ✓No monthly fees or minimum requirements ever

- ✓Innovative savings buckets for goal setting

- ✓Surprise savings and boosters features

- ✓Excellent mobile app and online tools

Cons

- ✗APY lower than top competitors (3.30%)

- ✗No physical branch access

- ✗Transfers can take longer during weekends

American Express High Yield Savings

American Express High Yield Savings offers a respectable 3.30% APY with the trusted Amex name. While the rate isn't the highest, existing American Express customers benefit from easy integration with their cards and the company's renowned customer service.

Pros

- ✓Solid 3.30% APY with no requirements

- ✓No monthly fees or minimum balance

- ✓Backed by American Express reputation

- ✓Easy integration with Amex credit cards

- ✓Strong customer service and security

Cons

- ✗APY lower than specialized online banks

- ✗Limited product offerings beyond savings

- ✗Best value when combined with Amex cards

Wealthfront Cash Account

Wealthfront Cash Account delivers 3.25% APY with exceptional FDIC insurance up to $5 million through partner banks. It's ideal for investors who want their savings integrated with their Wealthfront investment portfolio, offering a unified financial management experience.

Pros

- ✓FDIC insurance up to $5 million ($10M joint)

- ✓Seamless integration with investment accounts

- ✓No account or overdraft fees

- ✓Strong mobile app and automation features

- ✓Only $1 minimum to open

Cons

- ✗Lower APY compared to dedicated savings banks

- ✗Primarily focused on investment services

- ✗May be complex for those wanting simple savings

How We Evaluate High-Yield Savings Accounts

Our expert team uses a comprehensive methodology to compare Discover and alternative high-yield savings accounts. Here’s what we evaluate:

Annual Percentage Yield (APY)

We track and compare current interest rates:

- Current APY: How much your money earns annually

- Rate stability: Historical rate changes over the past 12-24 months

- Tiered rates: Whether APY changes based on balance amount

- Comparison to benchmarks: vs. national average (0.63%) and federal funds rate

- Frequency of changes: How often the bank adjusts rates

Fees and Requirements

We analyze costs that can reduce your earnings:

- Monthly maintenance fees (automatic disqualifiers)

- Minimum opening deposit requirements

- Minimum balance requirements to earn top APY or avoid fees

- Transaction limits and associated fees

- Transfer fees (ACH, wire, external transfers)

- Account closure fees

Access and Liquidity

We evaluate how easily you can access your money:

- Transfer methods available (ACH, wire, mobile app, debit card)

- Transfer speed (same-day, next-day, 1-3 business days)

- Withdrawal limits per month

- ATM access and fee reimbursements

- Mobile check deposit availability and limits

- Business hours for customer service

Account Features

We test additional tools and benefits:

- Mobile app quality, functionality, and user ratings

- Automatic savings tools (round-ups, recurring transfers)

- Savings goals and bucket features for organizing funds

- Linked checking account benefits

- Customer service quality, availability, and response time

- Additional perks (credit monitoring, financial tools, bonuses)

Safety and Security

We verify account protection measures:

- FDIC insurance coverage (standard $250,000 or higher through partnerships)

- Bank financial health ratings and history

- Security features (2FA, biometric login, account alerts)

- Fraud protection policies and customer liability

- Privacy policies and data protection practices

Discover vs. Top Competitors: Head-to-Head

Discover vs. Marcus by Goldman Sachs

Both offer 3.65% APY with no fees or minimums, making them nearly identical on paper. The differences come down to features and brand:

Choose Discover if you want:

- Free FICO credit score monitoring

- Occasional new customer bonuses

- Potential for future checking account integration

Choose Marcus if you want:

- Goldman Sachs brand reputation and stability

- Focus exclusively on savings and CD products

- Slightly more modern website interface

Discover vs. Ally Bank

Ally offers a lower APY (3.30%) but makes up for it with superior features:

Choose Discover if you want:

- Higher APY (0.35% more, worth $35/year per $10,000)

- Free credit score monitoring

- Simpler account structure

Choose Ally if you want:

- Best-in-class 24/7 customer service

- Savings buckets for goal organization

- Surprise Savings and automatic boost features

- Seamless integration with Ally Checking

Discover vs. Bread Savings

Bread Savings offers a significantly higher 4.05% APY:

Choose Discover if you want:

- No minimum deposit to open (vs. $100)

- Free credit monitoring

- More established brand name

- Better customer service hours

Choose Bread Savings if you want:

- Higher returns (0.40% more = $100/year per $25,000)

- Simple focus on high-yield savings

- Willing to meet $100 opening deposit

Discover vs. Capital One 360

Capital One offers 3.40% APY with unique hybrid banking:

Choose Discover if you want:

- Higher APY (0.25% more, worth $25/year per $10,000)

- Free FICO credit score monitoring

- Pure online banking experience

Choose Capital One 360 if you want:

- Access to physical Capital One Cafes

- Integration with Capital One checking and credit cards

- Same-day transfer options

- Broader banking ecosystem

Who Should Choose Discover?

Ideal Discover Customers

Credit-conscious savers: The free FICO credit score monitoring is valuable if you’re building or monitoring your credit. This feature alone saves $15-30/month compared to paid credit monitoring services.

Brand loyalists: If you already have a Discover credit card and appreciate their customer service, adding a savings account creates a unified banking relationship.

Simplicity seekers: Discover’s straightforward account structure with no tiers, no requirements, and no gimmicks appeals to those who want reliable savings without complexity.

Customer service focused: The 24/7 U.S.-based customer service provides peace of mind if you value being able to speak with knowledgeable representatives anytime.

Who Should Consider Alternatives

Rate maximizers: If getting the absolute highest APY is your priority, Bread Savings (4.05%) or Barclays (3.85%-4.00%) deliver measurably better returns.

Large balance savers: With significant savings ($50,000+), the rate difference becomes substantial. A 0.40% gap on $50,000 equals $200/year—worth considering alternatives.

Feature seekers: Ally’s savings buckets, SoFi’s investment integration, or Wealthfront’s automated tools offer more sophisticated money management.

ATM access needs: Synchrony includes an ATM card with fee reimbursements, better for those wanting physical access to savings.

Understanding High-Yield Savings Accounts

What Makes Them “High-Yield”?

Traditional brick-and-mortar banks offer average savings APYs around 0.01-0.10% because of their overhead costs (branches, staff, facilities). Online banks and digital divisions of traditional banks pass these savings to customers through APYs of 3-4%, offering 30-100x more interest.

How Much Can You Actually Earn?

Here’s the real difference high-yield accounts make:

$10,000 balance for one year:

- Traditional bank at 0.10% APY = $10 interest

- Discover at 3.65% APY = $365 interest

- Bread Savings at 4.05% APY = $405 interest

- Discover advantage over traditional: $355 more

- Bread Savings advantage over Discover: $40 more

$25,000 balance for one year:

- Traditional bank at 0.10% APY = $25 interest

- Discover at 3.65% APY = $912.50 interest

- Bread Savings at 4.05% APY = $1,012.50 interest

- Discover advantage over traditional: $887.50 more

- Bread Savings advantage over Discover: $100 more

Are High Rates Sustainable?

Savings account rates generally follow the Federal Reserve’s federal funds rate. When the Fed raises rates, savings APYs go up; when they cut rates, savings APYs decline.

The Fed cut rates three times in late 2026, with the current target range between 3.50% and 3.75%. This caused savings rates to drop from peaks of 4.50-5.00% to current levels of 3.25-4.05%. However, these rates remain exceptional compared to:

- Historical average of 1-2% (pre-2020)

- Current national average of 0.63%

- Traditional bank averages of 0.01-0.10%

Expect rates to continue fluctuating with Fed policy, but the gap between online and traditional banks should persist.

Types of Savers and Best Account Matches

Emergency Fund Builders

Best choice: Accounts with no requirements and easy access

- Bread Savings (4.05% APY, straightforward)

- Marcus by Goldman Sachs (3.65% APY, simple structure)

- Discover (3.65% APY, excellent service)

Why: You need reliable access without worrying about maintaining direct deposits or transaction counts. Emergency funds should be liquid and dependable.

Large Balance Savers ($50,000+)

Best choice: Accounts with highest absolute APY

- Bread Savings (4.05% APY, no balance cap up to $1M)

- Barclays (4.00% APY on $250,000+)

- CIT Bank (3.75% APY on $5,000+)

Why: Rate differences matter more with larger balances. An extra 0.40% on $100,000 equals $400/year—worth the effort to switch.

Credit Score Monitors

Best choice: Accounts with built-in credit tracking

- Discover (3.65% APY + free FICO monitoring)

- SoFi (4.00% APY with direct deposit + credit monitoring)

Why: Free credit score monitoring saves $15-30/month while you earn competitive interest. Perfect for those building or maintaining good credit.

Customer Service Focused

Best choice: Accounts with superior support

- Ally Bank (3.30% APY, legendary 24/7 service)

- Discover (3.65% APY, 24/7 U.S.-based support)

- Marcus (3.65% APY, excellent service ratings)

Why: Peace of mind knowing you can get help anytime is worth a slightly lower APY for some savers.

Goal-Oriented Savers

Best choice: Accounts with organizational tools

- Ally Bank (savings buckets and goal tracking)

- Capital One 360 (multiple savings accounts allowed)

- SoFi (savings vaults for specific goals)

Why: Visual tools and separate buckets help you save for specific goals (vacation, down payment, wedding) while earning interest.

Investors and High Net Worth

Best choice: Accounts with investment integration or enhanced FDIC

- Wealthfront (3.25% APY, $5M FDIC coverage, investment integration)

- SoFi (4.00% APY with direct deposit, $2M FDIC coverage)

Why: Integration with investment accounts and enhanced FDIC coverage through partner banks protects larger deposits.

Maximizing Your High-Yield Savings Returns

Opening Multiple Accounts

Many savvy savers use 2-3 accounts strategically:

Primary emergency fund: Highest APY account (Bread Savings 4.05%) Active savings goals: Feature-rich account (Ally with buckets) Quick access money: Account at your primary bank for instant transfers

This strategy optimizes both returns and accessibility.

Rate Shopping Discipline

Set calendar reminders every 6 months to review rates. Banks frequently adjust APYs, and what’s best today may not be in six months. However, avoid constant switching—the time cost and transfer delays usually outweigh small rate differences (0.10-0.20%).

Worth switching: 0.30%+ APY difference on large balances Not worth switching: Less than 0.20% difference on balances under $10,000

Promotional Bonuses

Discover and other banks periodically offer new customer bonuses ($150-200). These can boost your effective first-year APY significantly:

Example: $200 bonus for depositing $25,000 and maintaining for 90 days

- Equals additional 0.80% APY for one year

- Combined with 3.65% APY = effective 4.45% first year

Always read terms carefully—requirements typically include minimum deposits, holding periods, and may exclude certain transfers.

Automatic Savings Strategies

Set up automatic transfers from checking to savings on payday:

- $500/month for 12 months = $6,000 saved

- At 3.65% APY with monthly compounding ≈ $120 interest earned

- Total: $6,120 (vs. $6,000 without interest)

The automation ensures consistent saving, while high-yield returns provide meaningful growth.

Frequently Asked Questions

How safe is Discover Online Savings?

Completely safe. Discover is FDIC-insured, meaning your deposits are protected up to $250,000 per depositor, per institution. Discover Bank has been around since 1985 and maintains strong financial health ratings. Your savings are as secure as at any traditional bank.

Can Discover lower my APY after I open an account?

Yes. All savings account APYs are variable, including Discover’s. Rates typically follow Federal Reserve changes—when the Fed cuts rates, banks lower savings APYs within weeks or months. Discover has historically adjusted rates in line with other online banks. However, even after cuts, high-yield accounts remain far superior to traditional bank rates.

How do I get the free FICO score with Discover?

Once you open a Discover Online Savings Account, FICO score access is automatically included at no cost. You can view your score through the Discover online banking portal or mobile app. The score updates monthly and includes factors affecting your credit.

How long do transfers take with Discover?

External ACH transfers typically take 1-3 business days. Transfers initiated before cutoff time (varies by account) usually complete in 1-2 days. Wire transfers are faster (same or next business day) but may incur fees. Internal transfers between Discover accounts are typically same-day.

Should I choose Discover or Marcus by Goldman Sachs?

Both offer identical 3.65% APY with no fees or minimums. Choose Discover if you want free FICO credit score monitoring, occasional new customer bonuses, and established customer service. Choose Marcus if you prefer the Goldman Sachs brand reputation and a slightly more modern interface. You can’t go wrong with either.

Can I lose money in a high-yield savings account?

No, your principal is protected in FDIC-insured accounts like Discover. You cannot lose your deposited money. The only “loss” is opportunity cost—if inflation exceeds your interest rate, your purchasing power decreases. At 3.65% APY with 3% inflation, you maintain purchasing power. At 0.10% traditional bank APY with 3% inflation, you lose 2.90% in purchasing power annually.

What’s the difference between APY and interest rate?

APY (Annual Percentage Yield) includes compound interest and represents what you’ll actually earn in a year. Interest rate is the simple rate before compounding. Most banks advertise APY because it’s slightly higher and more accurate. For savings accounts with daily compounding, the difference is minimal (a 3.60% interest rate equals approximately 3.65% APY).

How often does Discover pay interest?

Discover compounds interest daily and credits it to your account monthly. Daily compounding earns slightly more because each day’s interest starts earning interest the next day, creating compound growth.

Is Discover better than keeping money at a traditional bank?

For pure savings, yes. Discover’s 3.65% APY is 30-50x higher than typical traditional bank savings rates (0.01-0.10%). On $10,000, that’s $355/year more in interest. However, traditional banks offer in-person service and branch access. Many people use both: traditional bank for checking/daily transactions, high-yield account like Discover for savings.

Can I have both a Discover savings and checking account?

Currently, Discover primarily focuses on savings accounts, CDs, and credit cards. They offer limited checking products in certain markets. Check their website for current offerings. However, you can easily pair Discover savings with a checking account from any other bank—most savers link their primary checking to their high-yield savings for transfers.

How does Discover compare for retirement savings?

High-yield savings accounts like Discover are best for emergency funds and short-term goals (under 3-5 years). For retirement savings, consider tax-advantaged accounts like IRAs or 401(k)s invested in stocks and bonds for potentially higher long-term returns. Use Discover for your emergency fund (3-6 months expenses), then invest retirement funds more aggressively.

What happens if I withdraw money frequently?

Discover allows unlimited withdrawals (federal Regulation D limits were suspended). However, excessive transactions might prompt the bank to contact you or convert the account type. For frequent access, consider pairing savings with a checking account and only transferring what you need for expenses.