Article

Best Debt Management Plans in 2026

Find the best debt management plans to pay off credit card debt faster with lower interest rates. Our experts compared nonprofit DMP providers for fees, success rates, and interest savings.

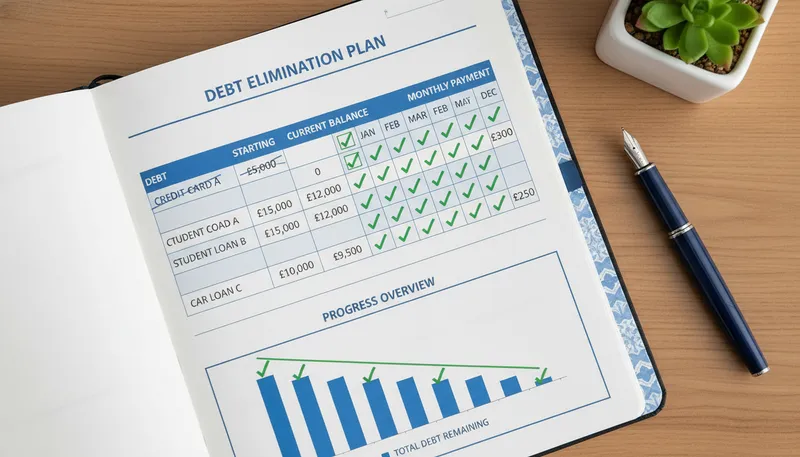

Credit card debt with high interest rates can take decades to pay off with minimum payments. A debt management plan (DMP) combines your debts into one monthly payment with significantly reduced interest rates, helping you become debt-free in 3-5 years.

Our team researched the leading DMP providers, evaluating success rates, interest savings, fees, and client outcomes. Here are the best debt management plans for 2026.

Quick Comparison

| Provider | Best For | Monthly Fee | Rating |

|---|---|---|---|

| 1. Money Management International (MMI) | Best Overall Debt Management Plan | $27 average (max $59) | ★4.8/5 |

| 2. GreenPath Financial Wellness | Best Success Rate | $28 monthly | ★4.7/5 |

| 3. Cambridge Credit Counseling | Best for Interest Rate Reduction | $30 average (max $50) | ★4.6/5 |

| 4. American Consumer Credit Counseling (ACCC) | Best Low-Cost DMP | $7 per account (max $70) | ★4.5/5 |

| 5. InCharge Debt Solutions | Best for Military Members | $34 average ($20-$40 range) | ★4.5/5 |

| 6. Apprisen | Best for Comprehensive Services | $30-$50 | ★4.4/5 |

| 7. ClearPoint Credit Counseling | Best Digital Platform | $25-$40 | ★4.3/5 |

| 8. Family Credit Management | Best for Family Budgets | $30 average | ★4.2/5 |

| 9. Consolidated Credit | Best for Quick Enrollment | $25-$50 | ★4.1/5 |

| 10. Take Charge America | Best for Credit Card Debt | $25-$35 | ★4/5 |

Our Top Picks in Detail

Money Management International (MMI)

Money Management International operates the nation's largest debt management plan program. Since 1997, their clients have repaid over $10 billion in debt while saving an average of $48,000 in interest and improving credit scores by an average of 84 points upon completion.

Pros

- ✓Largest nonprofit DMP provider nationally

- ✓$48,000 average total interest savings

- ✓84-point credit score improvement typical

- ✓$10B+ in client debt repaid

- ✓NFCC accredited with certified counselors

Cons

- ✗Monthly fees up to $59 in some states

- ✗3-5 year program commitment required

- ✗Must close enrolled credit accounts

GreenPath Financial Wellness

GreenPath Financial Wellness boasts the industry's highest success rate, with 75% of clients successfully paying off debt within 3-5 years. Founded in 1961, they offer free counseling sessions and average interest savings of $2,500 through their comprehensive DMP programs.

Pros

- ✓75% of clients complete plan in 3-5 years

- ✓Average savings of $2,500 in interest

- ✓No fees for counseling sessions

- ✓Available in all 50 states

- ✓Partnerships with 100+ financial institutions

Cons

- ✗$35 one-time enrollment fee

- ✗$28 ongoing monthly fee

- ✗Requires multi-year commitment

Cambridge Credit Counseling

Cambridge Credit Counseling excels at negotiating dramatic interest rate reductions, bringing average credit card rates down from 22% to 8%. Since 1996, their NFCC-certified counselors have helped clients save an average of $140 monthly through their debt management plans.

Pros

- ✓Reduces rates from 22% to 8% average

- ✓Clients save $140 per month typically

- ✓NFCC and HUD certified agency

- ✓Transparent fee structure

- ✓Extensive counselor training program

Cons

- ✗Fees vary by state ($40-$75 setup)

- ✗May require multiple counseling sessions

- ✗Limited evening/weekend availability

American Consumer Credit Counseling (ACCC)

American Consumer Credit Counseling offers the industry's most affordable debt management plans at just $7 per enrolled account monthly. This NFCC nonprofit helped over 4,000 people eliminate $96 million in debt during 2024 with budget-friendly, transparent pricing.

Pros

- ✓Lowest monthly fees at $7 per account

- ✓Average total monthly fee just $25

- ✓Helped pay off $96M+ in 2024 alone

- ✓Served 4,000+ clients in 2024

- ✓Simple, transparent pricing structure

Cons

- ✗Smaller organization than MMI/GreenPath

- ✗Basic online tools and technology

- ✗Limited additional services

InCharge Debt Solutions

InCharge Debt Solutions provides specialized debt management plans for military members and their families since 1997. As an NFCC-accredited nonprofit, they help 65% of clients become debt-free in 3-5 years with typical interest savings of $1,500-$4,000.

Pros

- ✓Specialized military debt programs

- ✓65% eliminate debt within 3-5 years

- ✓6-12% typical APR reduction

- ✓$1,500-$4,000 average interest savings

- ✓NFCC accredited nonprofit

Cons

- ✗State-dependent fee variations

- ✗Education focus may extend timeline

- ✗Limited office locations

Apprisen

Apprisen offers comprehensive debt management plans alongside HUD-approved housing counseling, student loan guidance, and bankruptcy education since 1999. Their multi-service approach addresses various debt types beyond just credit cards for a complete financial solution.

Pros

- ✓HUD-approved housing counseling included

- ✓Student loan counseling available

- ✓Bankruptcy counseling offered

- ✓Multi-state coverage

- ✓Comprehensive financial education

Cons

- ✗Higher fees ($40-$75 setup)

- ✗Not available in all states

- ✗May require in-person meetings

ClearPoint Credit Counseling

ClearPoint Credit Counseling Solutions modernizes debt management with an advanced online platform and mobile app for real-time account tracking. With over 50 years of experience, they combine traditional counseling expertise with cutting-edge technology for convenient DMP management.

Pros

- ✓Advanced online platform and mobile app

- ✓Real-time account access and tracking

- ✓Over 50 years of experience

- ✓Phone and online counseling available

- ✓Free credit report analysis

Cons

- ✗Less personal than in-person agencies

- ✗Technology learning curve for some

- ✗Limited physical office locations

Family Credit Management

Family Credit Management specializes in household debt management plans that consider entire family finances since 1999. Their unique approach includes collaborative budget development, multi-generational counseling, and educational programs designed for family financial wellness.

Pros

- ✓Family-oriented financial approach

- ✓Household budget development

- ✓Multi-generational counseling

- ✓Educational programs for all ages

- ✓Personalized family action plans

Cons

- ✗Limited geographic service area

- ✗Fewer counselors than larger agencies

- ✗May require family involvement

Consolidated Credit

Consolidated Credit offers fast-track debt management plan enrollment for clients who want to start immediately. Since 1993, they've achieved an impressive 80% completion rate with an average 30% debt reduction and 3-4 year timeline to debt freedom.

Pros

- ✓Streamlined enrollment process

- ✓30% average total debt reduction

- ✓80% client completion rate

- ✓Average 3-4 year completion time

- ✓Nearly 30 years of experience

Cons

- ✗Fee range varies significantly

- ✗Limited counseling depth

- ✗Focus on speed over education

Take Charge America

Take Charge America has specialized in credit card debt management plans since 1987. Their deep creditor relationships and card-specific expertise help clients consolidate multiple credit card payments into one simplified monthly payment with reduced interest rates.

Pros

- ✓Credit card debt specialists

- ✓Over 35 years of experience

- ✓Simplified single payment system

- ✓Direct creditor relationships

- ✓Flexible payment scheduling

Cons

- ✗Limited to certain geographic regions

- ✗Smaller counselor network

- ✗Less diverse debt type experience

How We Evaluate Debt Management Plans

Our expert team uses a comprehensive methodology to evaluate debt management plan providers. Here’s what we measure:

Success and Completion Rates

We analyze program effectiveness:

- Completion percentage: How many clients finish their DMP

- Average timeline: Typical time from enrollment to debt-free

- Success factors: What helps clients complete programs

- Dropout analysis: Common reasons for non-completion

- Long-term outcomes: Financial health after program completion

Interest Rate Reductions

We evaluate negotiation effectiveness:

- Starting interest rates vs. reduced rates

- Percentage point reductions achieved

- Total interest savings over program duration

- Consistency of rate reductions across creditors

- Fee reductions or waivers obtained

Fees and Total Cost

We calculate complete program expense:

- One-time setup or enrollment fees

- Monthly maintenance charges

- State-by-state fee variations

- Fee waivers for financial hardship

- Total cost compared to interest saved

Accreditation and Standards

We verify organizational quality:

- NFCC (National Foundation for Credit Counseling) membership

- Counselor certification and training

- Nonprofit 501(c)(3) status

- State licensing and compliance

- Industry association memberships

Frequently Asked Questions

What is a debt management plan?

A debt management plan (DMP) is a structured repayment program where a nonprofit credit counseling agency negotiates with your creditors to reduce interest rates (typically from 20-30% down to 8%) and combines your payments into one monthly bill. You pay 100% of what you owe over 3-5 years.

How does a DMP differ from debt consolidation?

A DMP doesn’t require a loan—the agency makes payments to creditors on your behalf with reduced interest rates. Debt consolidation uses a new loan to pay off old debts. DMPs typically have minimal fees ($30-60/month) while consolidation loans may charge 3-8% in origination fees.

Will a DMP hurt my credit?

Initially, yes. Enrolled credit accounts are closed, which may lower your score temporarily. However, DMPs cause far less credit damage than debt settlement or bankruptcy. Most clients see credit scores improve by 84-100 points after successfully completing their DMP through on-time payments and debt reduction.

How much can I save with a debt management plan?

Cambridge Credit Counseling clients average $140/month in savings. MMI clients save an average of $48,000 in total interest over the life of their plan. Actual savings depend on your starting interest rates, total debt, and negotiated reductions (typically 6-12% APR reduction).

What types of debt qualify for a DMP?

DMPs work for unsecured debts including credit cards, personal loans, medical bills, and store cards. They do NOT work for secured debts (mortgages, auto loans), federal student loans, child support, alimony, or most tax debts.

How long does a debt management plan take?

Most DMPs last 3-5 years. GreenPath reports 75% of clients complete within this timeframe. Consolidated Credit averages 3-4 years, while MMI clients typically finish in under 5 years. Timeline depends on total debt and your monthly payment capacity.

Can I use credit cards while on a DMP?

No. Enrolled credit accounts are closed when you enter a DMP. You may be allowed to keep one card for emergencies (not enrolled in the plan), but the goal is to stop using credit while paying off debt. This is essential to program success.

What’s the completion rate for debt management plans?

The FTC reports an average 50% completion rate industry-wide, though individual agencies vary from 35% to 75%. GreenPath achieves 75%, Consolidated Credit reports 80%, and MMI doesn’t publish a specific rate but has helped millions complete their programs successfully.