Article

10 Best Annuity Companies for Retirement Income in 2025

Secure your retirement with the best annuity providers of 2025. Compare fixed, variable, and indexed annuities from top-rated insurance companies for guaranteed lifetime income.

Annuities provide guaranteed income for retirement, offering peace of mind that you won’t outlive your savings. Whether you want fixed returns, market-linked growth, or immediate income, there’s an annuity for your needs.

Our team analyzed over 50 annuity providers, comparing financial strength, rates, fees, and product features. Here are the 10 best annuity companies for 2025.

Quick Comparison

| Company | Best For | AM Best Rating | Rating |

|---|---|---|---|

| 1. New York Life | Best Overall | A++ | ★4.9/5 |

| 2. TIAA | Best for Educators | A++ | ★4.8/5 |

| 3. Allianz Life | Best Indexed Annuities | A+ | ★4.8/5 |

| 4. MassMutual | Best Fixed Annuities | A++ | ★4.7/5 |

| 5. Nationwide | Best for Flexibility | A+ | ★4.7/5 |

| 6. Prudential | Best Variable Annuities | A+ | ★4.6/5 |

| 7. Lincoln Financial | Best Income Riders | A+ | ★4.6/5 |

| 8. Pacific Life | Best for High Net Worth | A+ | ★4.5/5 |

| 9. Fidelity & Guaranty Life | Best Bonus Annuities | A- | ★4.5/5 |

| 10. Athene | Best Rates | A | ★4.4/5 |

Our Top Picks in Detail

New York Life

New York Life is America's largest mutual life insurer with the highest possible financial ratings. Their annuities offer strong guarantees backed by unmatched financial stability.

Pros

- ✓Highest financial strength rating

- ✓165+ years in business

- ✓Wide variety of annuity products

- ✓Strong guaranteed rates

- ✓Excellent customer service

Cons

- ✗Higher minimum investments

- ✗Limited online tools

- ✗Must work with agent

TIAA

TIAA has served educators and nonprofit employees for over 100 years. Their annuities feature no surrender charges and low expenses, making them excellent value.

Pros

- ✓No surrender charges on traditional annuity

- ✓Low fees compared to competitors

- ✓Specializes in nonprofit sector

- ✓Lifetime income options

- ✓Strong financial ratings

Cons

- ✗Limited to eligible organizations

- ✗Fewer product options

- ✗Less brand recognition

Allianz Life

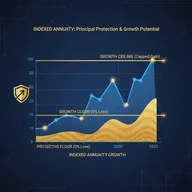

Allianz is the leader in fixed indexed annuities, offering sophisticated products that provide market-linked growth potential while protecting against losses.

Pros

- ✓Industry-leading indexed products

- ✓Upside potential with downside protection

- ✓Multiple crediting strategies

- ✓Bonus options available

- ✓Strong global backing

Cons

- ✗Complex products to understand

- ✗Longer surrender periods

- ✗Caps may limit gains

MassMutual

MassMutual's mutual ownership structure means policyholders may receive dividends. Their fixed annuities offer competitive guaranteed rates with excellent stability.

Pros

- ✓Competitive fixed rates

- ✓Mutual company structure

- ✓Participating dividends possible

- ✓Strong guarantees

- ✓Long track record

Cons

- ✗Limited indexed options

- ✗Agent-only sales

- ✗Higher minimums for best rates

Nationwide

Nationwide offers the widest variety of annuity products with flexible terms. Their living benefit riders provide income guarantees while maintaining growth potential.

Pros

- ✓Wide range of products

- ✓Shorter surrender periods available

- ✓Living benefit riders

- ✓Good online tools

- ✓Pet insurance discount

Cons

- ✗Variable fees can be high

- ✗Complex rider options

- ✗Rate not always top tier

Prudential

Prudential's variable annuities offer extensive investment options with optional guaranteed income riders, ideal for those wanting market participation with safety nets.

Pros

- ✓Strong variable annuity options

- ✓Extensive investment choices

- ✓Guaranteed lifetime income riders

- ✓Large financial advisor network

- ✓Research and planning tools

Cons

- ✗Higher fees on variable products

- ✗Complex product lineup

- ✗Investment risk on variable

Lincoln Financial

Lincoln's i4LIFE and similar riders offer some of the best guaranteed lifetime income benefits in the industry, with flexibility to adapt to changing needs.

Pros

- ✓Industry-leading income riders

- ✓i4LIFE product flexibility

- ✓Lifetime income guarantees

- ✓Multiple payout options

- ✓Strong advisor support

Cons

- ✗Rider fees add up

- ✗Complex product features

- ✗Higher minimum investments

Pacific Life

Pacific Life caters to affluent clients with sophisticated annuity products offering high contribution limits and multiple crediting strategies.

Pros

- ✓Sophisticated product design

- ✓High limits for wealthy clients

- ✓Multiple crediting options

- ✓Good for tax deferral

- ✓Strong financial ratings

Cons

- ✗Higher minimums required

- ✗Complex products

- ✗Less suitable for average investor

Fidelity & Guaranty Life

FGL offers generous premium bonuses up to 10% that immediately boost your account value, though they come with longer surrender periods.

Pros

- ✓Up to 10% premium bonus

- ✓Competitive crediting rates

- ✓Multiple index options

- ✓Income rider available

- ✓Growth-focused designs

Cons

- ✗Longer surrender periods for bonus

- ✗Lower financial rating

- ✗Bonus vesting requirements

Athene

Athene consistently offers some of the highest fixed annuity rates in the market, making them attractive for rate-focused buyers willing to accept a newer carrier.

Pros

- ✓Among highest current rates

- ✓Multiple product options

- ✓Aggressive crediting strategies

- ✓Growing market presence

- ✓Online rate tracking

Cons

- ✗Newer company

- ✗Less brand recognition

- ✗Limited to fixed products

How We Evaluate Annuity Companies

Our comprehensive evaluation process includes:

Financial Strength

- AM Best ratings and outlook

- Comdex ranking comparison

- Claims-paying ability

- Company history and stability

Product Quality

- Guaranteed rates and terms

- Crediting strategy options

- Rider availability and value

- Surrender period reasonableness

Customer Experience

- Application process ease

- Customer service quality

- Online account access

- Claims processing speed

Frequently Asked Questions

What is an annuity?

An annuity is a contract with an insurance company that provides guaranteed income, either immediately or in the future. You make a lump sum or series of payments, and the insurer promises to pay you back with interest.

What’s the difference between fixed and variable annuities?

Fixed annuities guarantee a set interest rate, while variable annuities invest in market funds with potential for higher returns but also risk of loss. Fixed indexed annuities offer a middle ground.

At what age should I buy an annuity?

Most people purchase annuities between ages 55-70. Immediate annuities make sense closer to retirement, while deferred annuities work well starting in your 50s for tax-advantaged growth.

Are annuities safe?

Annuities are backed by the insurance company’s financial strength, not FDIC. Choose companies with A ratings or higher. Most states also have guaranty associations providing additional protection.

What fees do annuities charge?

Fixed annuities typically have no explicit fees but pay lower rates. Variable annuities charge 1-3% annually for management and riders. Always understand the fee structure before buying.

Can I access my money in an annuity?

Most annuities allow 10% annual withdrawals without penalty. Larger withdrawals during the surrender period incur charges. Immediate annuities typically don’t allow withdrawals.